Required minimum distribution 2021 calculator

The distributions are required to start when you turn age 72. Get a free bonus retirement guide.

Where Are Those New Rmd Tables For 2022

Retirees who are age 72 or above are required by the IRS to take a minimum distrubtion annually.

. Discover Fidelitys Range of IRA Investment Options Exceptional Service. IRA Required Minimum Distribution RMD Table for 2022. Use this calculator to determine your Required Minimum Distribution RMD.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. IRA Required Minimum Distribution Worksheet Use this worksheet for 2021 Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your. We will automatically calculate your distribution to help ensure your RMD is taken each year avoiding potential additional taxes.

Discover The Answers You Need Here. An RMD is the minimum amount of money you must withdraw from a tax-deferred retirement plan and pay ordinary income. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705.

This calculator has been updated for the SECURE Act. Its equal to 50 percent of the amount you were supposed to withdraw. Learn More About American Funds Objective-Based Approach to Investing.

The service also helps ensure that you do not over- or under. A required minimum distribution RMD. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from.

You reached age 72 on July 1 2021. Maya inherited an IRA from her mother. Ad Use This Calculator to Determine Your Required Minimum Distribution.

The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and costly mistakes. Build Your Future With a Firm that has 85 Years of Investment Experience. Tax law requires one to withdraw annually from traditional IRAs and employer-sponsored retirement plans.

Ad Click here for some simple facts about paying RMDs and managing retirement withdrawals. This calculator helps people figure out their required minimum distribution RMD to help them. 13 Retirement Investment Blunders to Avoid.

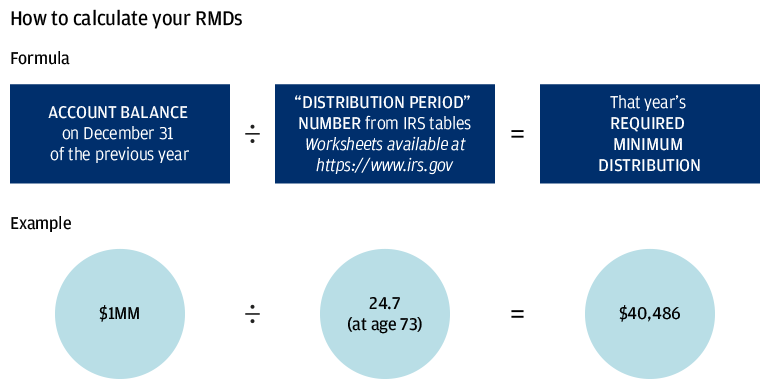

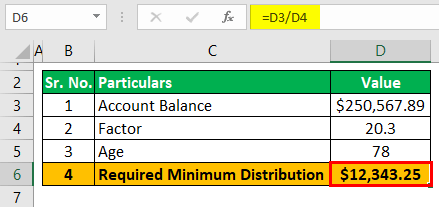

Account balance as of December 31 2021 7000000 Life expectancy factor. 1 Use FINRAsRequired Minimum Distribution Calculator to calculate your current years RMD. Use this calculator to determine your Required Minimum Distribution RMD.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Build Your Future With a Firm that has 85 Years of Investment Experience. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age.

Required minimum distribution Calculate your earnings and more The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you reach 72.

Required minimum distributions RMDs are amounts that US. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Your Required Minimum Distribution this year is 0 How is my RMD calculated.

How is my RMD calculated. What Is a Required Minimum Distribution RMD. You can also explore your IRA beneficiary withdrawal options based on.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

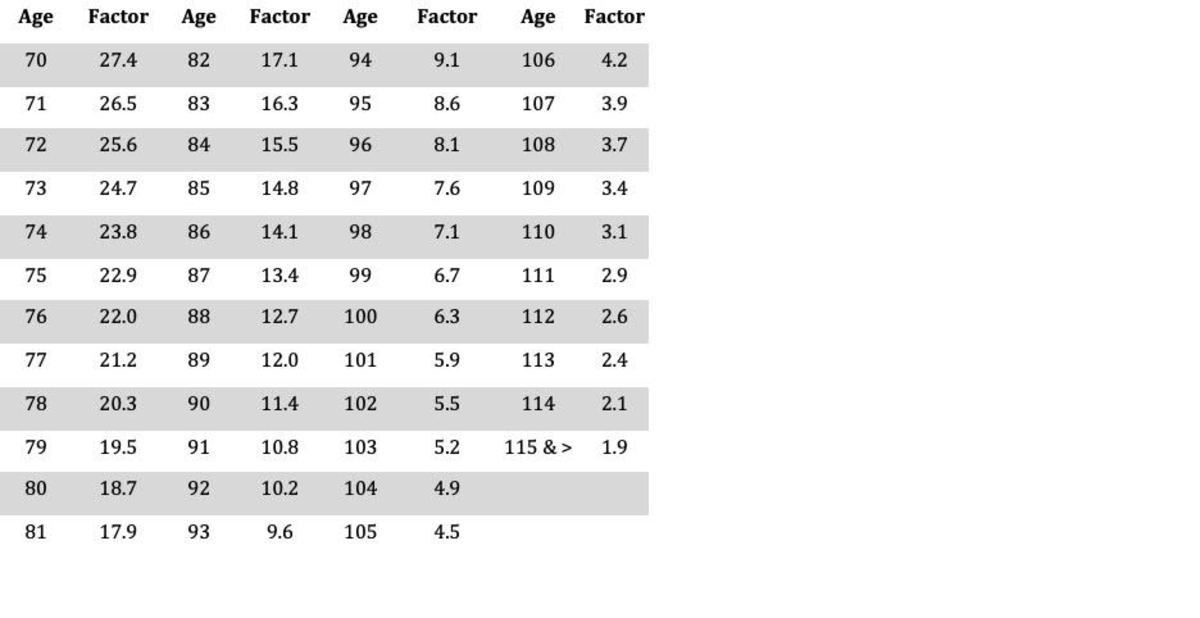

Once the factor is determined it can be divided into the December 31 2020 balance to get the RMD amount for 2021. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

IRA Required Minimum Distribution Worksheet Use this worksheet for 2021 Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA.

Rrif Withdrawals How To Calculate Your Rate Moneysense

Required Minimum Distribution Calculator Estimate Minimum Amount

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Rmd Table Rules Requirements By Account Type

Rmd Calculator Required Minimum Distributions Calculator

Required Minimum Distribution Calculator Estimate Minimum Amount

New Guidelines For Your Required Minimum Distributions Rmd Coming In 2022 Paul R Ried Financial Group Llc

Rmd Table Rules Requirements By Account Type

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2022 New Irs Required Minimum Distribution Rmd Tables

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Why Taking Rmds On Time Is So Important J P Morgan Private Bank

Required Minimum Distribution Calculator Estimate Minimum Amount

Taxtips Ca Rrsp Rrif Withdrawal Calculator

How To Calculate Rmds Forbes Advisor

Required Minimum Distribution Calculator Estimate Minimum Amount